U.S. Global Investors Reports 12% Sequential Growth in Assets Under Management in Q2 of Fiscal 2026

SAN ANTONIO, Feb. 20, 2026 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm1 with longstanding experience in global markets and specialized sectors, today reported financial results for the second quarter of fiscal 2026 ended December 31, 2025. Total assets under management (AUM) were approximately $1.5 billion at quarter-end, representing a 12% increase from the prior quarter and 5% higher than AUM at the end of the year-ago quarter. This rose to $1.7 billion in total AUM as of Thursday, February 19. Operating revenue increased by $259,000, or 11.5%, compared to the prior quarter, and by $279,000 compared to the quarter ended December 31, 2024. Additionally, the Company’s expenses decreased by $172,000 in the current quarter compared to the same quarter last year. The Company’s income before taxes was $535,000, a significant improvement from a loss before taxes of $116,000 in the quarter ended December 31, 2024.

During the three months ended December 31, 2025, the Company recorded a tax expense of approximately $1.3 million related to the tax treatment of certain HIVE Digital Technologies Ltd. (“HIVE”) convertible securities. However, the Company expects an offsetting tax benefit of $1.3 million in the quarter ending March 31, 2026. The tax expense included a non-cash valuation allowance of approximately $471,000 against deferred tax assets tied primarily to capital loss carryforwards. As a result, the Company’s effective tax rate for the quarter was significantly elevated. After quarter-end, the Company filed a tax accounting method change with the Internal Revenue Service (IRS) related to the treatment of these HIVE securities. Because the filing occurred after December 31, 2025, the anticipated $1.3 million benefit was not reflected in the December quarter results and remains subject to IRS review.

Shareholder Value Initiatives

The Company’s shareholder yield as of December 31, 2025, was 9.89%, more than double the yield on the five-year and 10-year Treasury bonds on the same trading day.2

The Company’s Board of Directors (the “Board”) approved payment of a $0.0075 per share per month dividend beginning in January 2026 and continuing through March 2026.

The Company maintains a share repurchase program, authorized by the Board, allowing for the annual purchase of up to $5 million of its outstanding common shares on the open market, as market and business conditions permit. The program has been in place since December 2012 and has been renewed each calendar year by the Board. During the three-month period ended December 31, 2025, the Company repurchased 262,195 shares.

Travel Demand Remains Resilient as Capacity Stays Constrained

The Company is pleased to report that air travel demand continued to prove resilient in 2025, even as airlines and airports faced persistent capacity constraints. The International Air Transport Association (IATA) reported that full-year passenger demand, measured in revenue passenger kilometers (RPKs), rose 5.3% versus 2024, while capacity (available seat kilometers, or ASKs) increased 5.2%. The global passenger load factor reached 83.6%—a record for full-year traffic—while international demand rose 7.1%, with a record international load factor of 83.5%.3

This strength has been visible across major markets. Airports Council International (ACI) Europe reported that passenger traffic across Europe’s airports increased 4.4% in 2025, with airports welcoming an additional 100 million passengers and reaching a new record of 2.6 billion passengers.4 Meanwhile, Airlines Reporting Corporation (ARC) data showed U.S.-based travel agency air ticket sales totaled over $100 billion in 2025, also a record.5

“Consumers are still prioritizing experiences, and the data continues to show that air travel remains one of the most resilient categories in the global economy,” said Frank Holmes, the Company’s Chief Executive Officer (CEO) and Chief Investment Officer (CIO). “Even with capacity constraints, the industry has been setting records for demand and load factors. That’s a constructive backdrop for investors looking at the long-term growth potential of the airlines and travel ecosystem.”

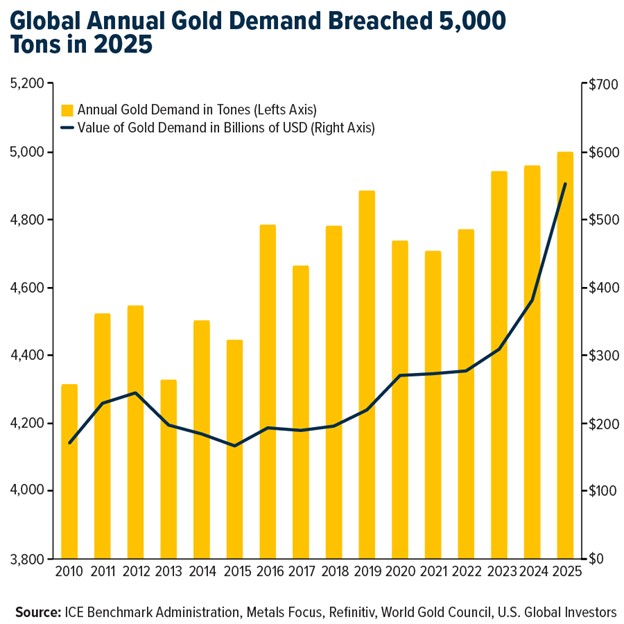

Gold Demand Breaks 5,000 Tons as Investors Seek Safe Haven

Gold demand and prices both reached historic milestones in 2025. According to the World Gold Council (WGC), total gold demand exceeded 5,000 metric tons for the first time ever, and the record-setting run in gold prices produced an unprecedented annual value of approximately $555 billion, up 45% year-over-year. The WGC also noted that central bank purchases totaled 863 tons in 2025, during which the gold price set 53 new all-time highs.6

Looking ahead, several major market observers expect gold to remain supported by continued diversification and macro uncertainty. Goldman Sachs raised its year-end 2026 gold forecast to $5,400 per ounce, citing continued demand from central banks as well as private sector diversification.7

“Gold has continued to do what it has historically done best—serve as a portfolio hedge during periods of macroeconomic and geopolitical uncertainty,” said Mr. Holmes. “When demand breaks records and central banks remain large buyers, it reinforces gold’s role as a strategic asset. Against that backdrop, we believe investors will continue to look closely at gold exposure, including the potential upside in quality precious metals miners.”

Healthy Liquidity and Capital Resources

As of December 31, 2025, the Company had net working capital of approximately $36.7 million. With approximately $25.2 million in cash and cash equivalents, the Company has adequate liquidity to meet its current obligations, in addition to investments in our funds.

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time on Monday, February 23, 2026, to discuss the Company’s key financial results for the quarter. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, director of marketing. Click to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

| Three months ended | ||||||

| 12/31/2025 | 12/31/2024 | |||||

| Operating Revenues | $2,510 | $2,231 | ||||

| Operating Expenses | 2,598 | 2,770 | ||||

| Operating Income (Loss) | (88) | (539) | ||||

| Total Other Income (Loss) | 623 | 423 | ||||

| Income (Loss) Before Income Taxes | 535 | (116) | ||||

| Income Tax Expense (Benefit) | 1,381 | (30) | ||||

| Net Income (Loss) | $(846) | $(86) | ||||

| Net Income (Loss) Per Share (Basic and Diluted) | $(0.07) | $(0.01) | ||||

| Avg. Common Shares Outstanding (Basic) | 12,762,003 | 13,497,961 | ||||

| Avg. Common Shares Outstanding (Diluted) | 12,765,706 | 13,498,306 | ||||

| Avg. Assets Under Management (Billions) | $1.5 | $1.5 | ||||

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides investment management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Frank Holmes serves as executive chairman of the Board of Directors of HIVE Digital Technologies. Both Mr. Holmes and U.S. Global Investors own securities of HIVE.

Carryforward is the process of transferring unspent funds, unused tax losses, or remaining credits from one budget, accounting, or tax period to the next.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

_______________________

1 Registration does not imply a certain level of skill or training.

2 The Company calculates shareholder yield by adding the percentage of change in shares outstanding, the dividend yield and any debt reduction for the 12 months ended December 31, 2025.

3 International Air Transport Association (IATA), « Strong 2025 Passenger Demand Masks Ongoing Capacity Constraints,” Press Release No. 5, January 29, 2026, https://www.iata.org/en/pressroom/2026-releases/2026-01-29-02/

4 Airports Council International Europe (ACI EUROPE), “2025 All about Traffic Resilience as Europe’s Airports Welcomed an Additional 100 Million Passengers,” February 5, 2026, https://www.aci-europe.org/mediaroom/579-2025-all-about-traffic-resilience-as-europe-s-airports-welcomed-an-additional-100-million-passengers.html

5 Airlines Reporting Corporation (ARC), “Annual U.S. Travel Agency Air Ticket Sales Surpass $100 Billion for the First Time,” January 15, 2026, https://www2.arccorp.com/about-us/newsroom/2026-news-releases/december-2025-air-ticket-sales/

6 World Gold Council, “Gold Demand Trends: Q4 and Full Year 2025,” January 29, 2026, https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2025

7 Preeti Soni, “Goldman Raises Year-End Gold Forecast to $5,400 an Ounce,” Bloomberg, January 21, 2026, https://www.bloomberg.com/news/articles/2026-01-22/goldman-sachs-raises-year-end-gold-forecast-to-5-400-an-ounce

Contact:

Holly Schoenfeldt

Director of Marketing

210.308.1268

hschoenfeldt@usfunds.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b5c398d1-b579-4fda-9d39-59e383ef82a5

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.